The upshot: “We no longer see crypto as a reason not to own the stock,” Ferragu said. And that’s before seeing any upside from the company’s datacenter momentum, which “benefits from excellent demand driver and a product cycle,” he added. Since November 2021, the relative multiple has already contracted by 25%, the analyst estimated. It’s a legitimate fear given that Ethereum mining alone likely boosted Nvidia’s gaming revenue by about $2 billion in 2021, Ferragu calculated.įerragu doesn’t foresee such a drastic impact this time around in part because the market may already be pricing in a crypto correction. ) graphic chips could hurt the company’s revenue. It was something that Ferragu, in 2021, warned investors could happen again as a slowdown in cryptocurrency activity and oversupply of Nvidia (ticker:

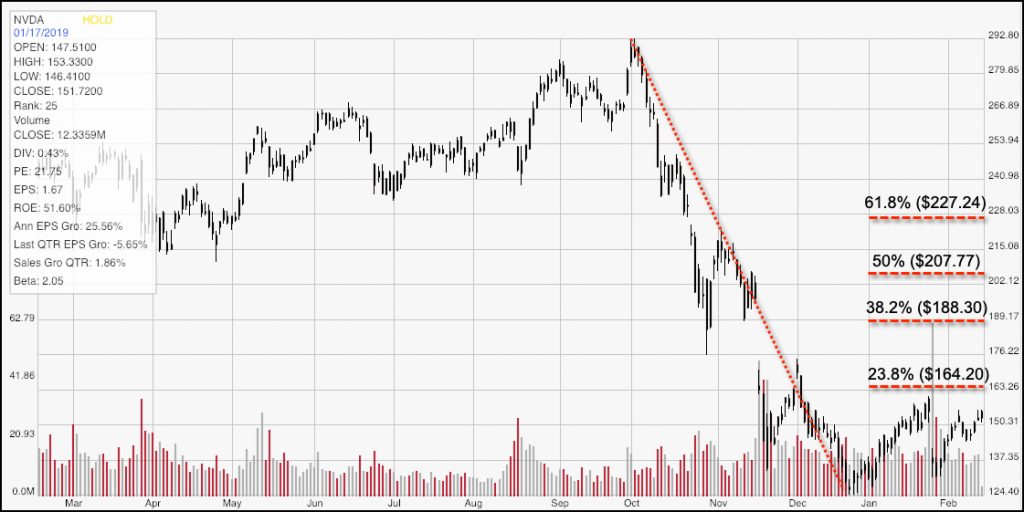

That was an issue in 2018, whenĪnd other cryptos crashed and Nvidia’s relative multiple contracted by about 30%, Ferragu noted, while sales took a hit for four straight quarters. One of the big concerns for investors is the impact of cryptomining on Nvidia’s revenue. Rolland noted that Nvidia’s neutral rating is the same, because "Nvidia has a stronger and more durable gaming franchise which would help it work through this potential Ethereum-related unwind.”Ī research report released in February of this year showed that the four-year-old Bitmain had made between $3 and $4 bln in profits in 2017, while the twenty-four-year-old Nvidia had made about $3 bln during the same time frame.“The secular outlook for gaming, visualization, and datacenter is still very strong, and on the datacenter front, near-term visibility is very strong as well, with supply constraints being the limiting factor,” he wrote in a research note. The new target price for AMD shares is $7.50, down from $13.00, and is $200 for Nvidia shares, down from $215 at Friday’s market close.

The preponderance of ETH ASIC miners will negatively affect AMD and Nvidia, according to Rolland, companies whose graphics cards for ETH mining make up about 20 and 10 percent of the companies’ respected revenues. Susquehanna analyst Christopher Rolland told clients in a note that Bitmain will be shipping an ASIC for mining ETH starting in the second quarter of 2018, adding that although “Bitmain is likely to be the largest ASIC vendor (currently 70-80% of Bitcoin mining ASICs) and the first to market with this product, we have learned of at least three other companies working on Ethereum ASICs, all at various stages of development." Wall Street firm Susquehanna has changed the rating of semiconductor firm AMD from neutral to negative and lowered the price forecast for shares in GPU processing manufacturer Nvidia, citing the rising competition from Bitmain’s Ethereum (ETH) mining ASICs, CNBC reports today, March 26.

0 kommentar(er)

0 kommentar(er)